Every nation’s economic development is largely dependent on the banking & finance sector as it shapes regulatory frameworks, money management practices and financial systems. This industry has a significant influence on currency regulation and therefore requires a thorough understanding through market research. As a top international research company, we have led the way in offering priceless insights in a variety of industries, with a concentration on the banking & finance sector. Our proficiency in market research has enabled numerous firms to effectively tackle obstacles and realize substantial profits amidst constantly changing financial landscapes.

The Importance of Market Research in Banking and Finance:

Market research is indispensable to banking operations and other financial institutions. The sector is characterized by frequently changing regulations and shifting consumer preferences and depends on thorough research to guide choices, develop strategies and adjust to shifting market conditions. Our unparalleled expertise in market research and dedication to providing up to date insights on the latest trends specifically in banking and finance has been significantly beneficial to numerous organizations in the sector.

Providing Valuable Insights:

As a leading provider of market and business research services, we regularly provide banking & financial companies with excellent research and useful insights. Our in-depth research covers markets, goods and consumer behaviour, allowing our clients to take advantage of sales opportunities and execute well informed tactical plans. Understanding that everything is examined under a research lens, from marketing plans to internal audits, we make sure that every financial decisions is based on credible data findings.

The Impact on Decision Making:

Data analysis is essential to financial operations. The requirements, tastes and everchanging customer trends can be traced via a well structured market research study. This creates opportunities for possible worldwide investments in addition to helping businesses adjust to shifting client dynamics. Thus, market research is a driving factor behind the success of individual companies as well as the continued growth of the banking & finance sector overall.

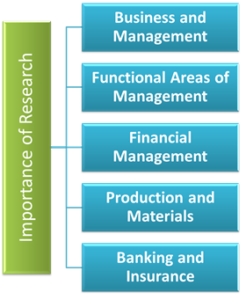

Important study Areas: Within the broad field of banking & finance,our study covers important areas such as business banking, credit cards, mortgages, insurance, pensions, personal loans, real estate and credit cards. These domains serve as hubs for comprehending market dynamics, spotting growth prospects and proficiently meeting customer requests.

Economic Research’s Vital Role: Economic research influences the choice of models & instruments required for monetary policies in addition to providing a conceptual framework for policy making. Working together with research driven experts makes it easier to use the most recent advancements, guaranteeing that institutions stay ahead of the curve and have a competitive advantage in the market.

Working Together for Growth: Partnering with IBI, a well-renowned market research firm, is a wise long term investment. Our seasoned team of experts and exceptional leaders provides unmatched services in market research. The caliber of our clientele speaks for us. In partnering with us you can rest assured that we leave no stone unturned in ensuring that your research needs as our client are met. We provide knowledge and perspectives our clients can take advantage of to propel their businesses to greater levels of success.

Conclusion:

In an evolving environment thorough market research has become even more essential to the banking and financial sector’s growth. In addition to enhancing judgement and promoting responsibility, market research establishes a strong basis for management procedures. Market research will undoubtedly continue to be crucial in guiding the banking and finance sector toward long term growth due to its enduring relevance.

Did you know?

– The global economy is expected to slow down in 2024, and the banking sector will face challenges due to a changing economic landscape. There will be new tests of bank’s capacity to control expenses and make money.

– A number of disruptive forces are transforming the basic structure of the banking & capital markets sector. The main forces causing this shift are rising interest rates, a shrinking money supply, stronger regulations, climate change and geopolitical conflicts.